illinois taxes due date 2021

The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday. Ad So you need to file a tax return every year.

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

3rd quarter July 2022 Monday August 1 5 2022.

. September 2022 Monday October 1 7 2022 1015 weekend IL-941 return due on Monday October 31 2022. We grant an automatic six-month extension of time to file your return. Mar 18 2021 at 735 pm Americans will be getting extra time to prepare their taxes.

Monthly sales tax due on november 22 2021. The filing deadline for 2021 tax returns is April 18 2022. Illinois taxes due date 2021.

Taxpayers expecting liabilities may benefit by this extension by deferring payment. These payments are still due on April 15 and can be based on either 100 of estimated or 90 of actual liability for 2021 or 100 of actual liabilities for. Under this system the first installment of taxes is 55 percent of last years tax bill.

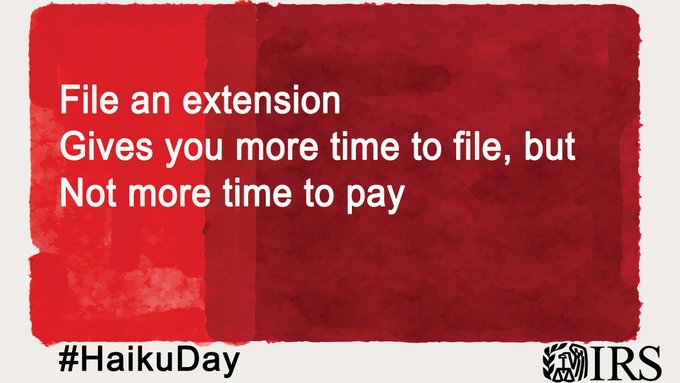

We will help you with that. Illinois Extends Income Tax Filing Deadline Pritzker Announces The extension does not apply to estimated tax payments due on April 15 2021 according to Pritzkers office. Taxpayers affected by the severe weather and tornadoes beginning December 10 2021 have been provided with an extension of time to file their 2021 IL-1040 until May 16 2022.

For more information see press release. An a symbol means the state has an amazon fulfillment center. Exemptions - Will County SOA This installment is mailed by January 31.

The filing extension does not apply to estimated tax payments that are due on April 15 2021. The deadline for filing the Illinois individual return has been. The payment deadline is also April 18 2022.

You may pay up to 90 of your last tax bill. Penalties on deposits due on or after December 10 2021 and before December 27 2021 will be abated as long as the tax deposits were made by December 27 2021. 3 as the due dates for 2021.

Sign up now and cross taxes off your to-do list. If you receive a federal extension of more than six months you are automatically allowed that extension for Illinois. On March 18 2021 Governor Pritzker announced that the 2020 Illinois tax filing and payment deadline would be extended from April 15 to May 17 2021 giving all Illinois taxpayers an extra month to file and pay their 2020 income tax liabilities.

Itll just take 30 minutes to file. This includes 2021 individual income tax returns due on April 18 as well as various 2021. The Illinois Department of Revenue IDOR will continue to process tax refunds for those filing ahead of the deadline.

The due date for filing your 2020 Form IL-1040 and paying any tax you owe is April 15 2021. As a result affected individuals and businesses will have until May 16 to file returns and pay any taxes that were originally due during this period. August 2022 Thursday September 1 5 2022.

The due dates for both installments is october 15 2021. Welcome to ford county illinois. No personal checks or postmarks accepted.

These extensions do not grant you an. This does NOT impact the estimated tax payments that are due on April 15 2021. Elsewhere a county board may set a due date as late as June 1 Due to the fuel price increases fuel costs for the 310 horsepower tractor increased from 3730 per hour.

IL-941 return due on Monday August 1 2022. The Internal Revenue Service and the State of Illinois have officially moved the 2020 income tax filing deadline for individuals to May 17 2021 from April 15 2021. June 4 2021 Published.

The Illinois Department of. For example if you were formed on july 15 2020 your annual report is due july 1 2021. This includes 2021 individual income tax returns due on April 18 as well as various 2021.

November 1 First Installment is due. Illinois Individual Income Tax refunds will only be issued through direct deposit or paper check. Illinois Estate Tax for Married Couples.

April 15 2021 to May 17 2021. 2018 Annual Tax Sale. Itll just take 30 minutes to file.

191 KB File Size. Tax Year 2020 Second Installment Due Date. FY 2022-22 Illinois Suspends the Inflation Adjustment to the Motor Fuel Tax Rate for Six Months from July 1 2022 through December 31 2022 562022 50000 AM Trending Resources.

These extensions do not grant you an extension of time to pay any tax. As a result affected individuals and businesses will have until May 16 to file returns and pay any taxes that were originally due during this period. Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due.

Mar 18 2021 at 515 pm Illinois residents will now have until May 17 to file their individual state income taxes and to make any payments Gov. Will County Treasurer Tim Brophy said the board should establish June 3 Aug. 2021 ILLINOIS TAX FILING SEASON BEGINS FRIDAY FEBRUARY 12 THE FASTEST WAY TO RECEIVE A REFUND IS TO FILE ELECTRONICALLY AND REQUEST DIRECT DEPOSIT SPRINGFIELD - The Illinois Department of Revenue IDOR will begin accepting 2020 state individual income tax returns on Friday February 12 the same date that the Internal Revenue Service IRS begins.

This installment is mailed by January 31. The Illinois income tax rate is 495 percent 0495. The original due date for filing your 2021 Form IL-1040 and paying any tax you owe is April 18 2022 unless you are claiming disaster relief due to the December 2021 tornadoes.

4th quarter October 2022 Tuesday November 1 5 2022. The Internal Revenue Service says its delaying the traditional tax filing deadline from April 15. We will help you with that.

If you receive a federal extension of more than six months you are automatically allowed that extension for Illinois. Late charges will begin on May 4 2021. November 5 2021 - November 12 2021.

Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due. In Cook County the first installment is due by March 1. Individual taxpayers can also postpone Federal and Illinois income tax payments due for the 2020 tax year to May 17 2021 without incurring additional penalties or interest.

Individual taxpayers can postpone Illinois income tax payments for the 2020 tax year due on April 15 2021 to May 17 2021. The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. Recreational Marijuana Taxes State of Illinois Office of the Attorney General.

January 1 Lien Datethe day your propertys value is assessed. This deadline extension coincides with the dates for filing federal income tax returns. Real Estate Tax Due Dates.

Illinois is following the lead of the Internal Revenue Service and extending the filing deadline for individual income taxes to May 17. In addition the quarterly payroll and excise tax returns normally due on January 31 2022 and May 2 2022 are also now due on May 16 2022. November 2022 Thursday December 15 2022.

Sign up now and cross taxes off your to-do list. Ad So you need to file a tax return every year. Penalties and interest on underpayments will be calculated from that date.

The balance is calculated.

Taxes Due Today Last Chance To File Your Tax Return Or Tax Extension On Time Cnet

Latest Updates Accounting Services Secretarial Services Consulting Business

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Have You Filed Yet Federal Income Tax Deadline Is April 18

Georgia State University Holiday Schedule 2020 Georgia State Georgia State University University Holidays

Pin By Wealth 4 India Private Limited On Compliance Due Dates Before 31st December 2019 Harmonized System How To Become Due Date

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Real Estate Newsletter Template Spring 2020 Newsletter Real Etsy In 2022 Newsletter Templates Real Estate Marketing Real Estate Agent Marketing

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Tax Planning Filing Business Formation Book Keeping And Itin Business Format Financial Statement Analysis Tax Services

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Illinoisans Can Submit State And Federal Tax Returns Starting January 24